Welcome to the future of cross-border payments! In this article, we’ll take a glimpse into the year 2024 and explore how the landscape of international transactions is set to evolve. As technology continues to advance at a rapid pace, the world of finance is not far behind. With globalization on the rise, businesses and individuals are increasingly engaging in cross-border trade, making efficient and secure payment solutions more crucial than ever.

In the coming years, we can expect to see significant advancements in cross-border payment systems. Traditional methods, such as wire transfers and checks, are bound to become relics of the past as digital alternatives take center stage. With the advent of blockchain technology and cryptocurrencies, transactions will become faster, more transparent, and less costly. Additionally, artificial intelligence and machine learning will play a pivotal role in enhancing fraud detection and risk management, ensuring the security of cross-border payments.

Get ready to dive into a world where borders are no longer barriers to seamless financial transactions. Join us as we explore the exciting possibilities that lie ahead in the realm of cross-border payments in 2024.

Growth of Cross-Border Trade

In the year 2024, the landscape of cross-border trade is expected to experience significant growth. The advancements in technology and globalization have paved the way for businesses to expand their operations beyond their home countries and establish a global presence. This has led to an increase in cross-border transactions and a growing need for efficient and secure payment solutions.

Here are some key factors contributing to the growth of cross-border trade in 2024:

- Global E-commerce: The rise of e-commerce platforms has made it easier for businesses to reach customers worldwide. With the increasing accessibility of online marketplaces, businesses can now sell their products or services to customers in different countries, leading to a surge in cross-border transactions.

- Emerging Markets: The rapid growth of emerging markets, particularly in Asia and Africa, has opened up new opportunities for businesses. These markets present a large consumer base with increasing purchasing power, attracting businesses to expand their reach internationally.

- Trade Agreements: The signing of trade agreements between countries has facilitated the flow of goods and services across borders by reducing trade barriers. These agreements have made it more convenient for businesses to engage in cross-border trade and have contributed to the growth of international commerce.

- Global Supply Chains: Businesses are increasingly relying on global supply chains to source materials, manufacture products, and distribute them to customers worldwide. This interconnectedness of supply chains has fueled the growth of cross-border trade as businesses engage in transactions with their international partners.

With the growth of cross-border trade, the demand for efficient and secure payment solutions becomes paramount. Traditional payment methods like wire transfers and checks are often slow, costly, and prone to errors. In 2024, businesses are expected to shift towards digital alternatives to streamline cross-border payments.

Blockchain technology and cryptocurrencies are anticipated to revolutionize cross-border payments by providing faster, more transparent, and cost-effective solutions. These digital payment methods eliminate intermediaries, reduce transaction fees, and enable quicker settlement times. Additionally, advancements in artificial intelligence and machine learning will enhance fraud detection and risk management in cross-border transactions, further boosting the confidence of businesses in conducting international payments.

The growth of cross-border trade in 2024 presents both exciting opportunities and challenges for businesses. By embracing technological advancements and adopting innovative payment solutions, businesses can thrive in the global marketplace and capitalize on the tremendous potential of cross-border trade.

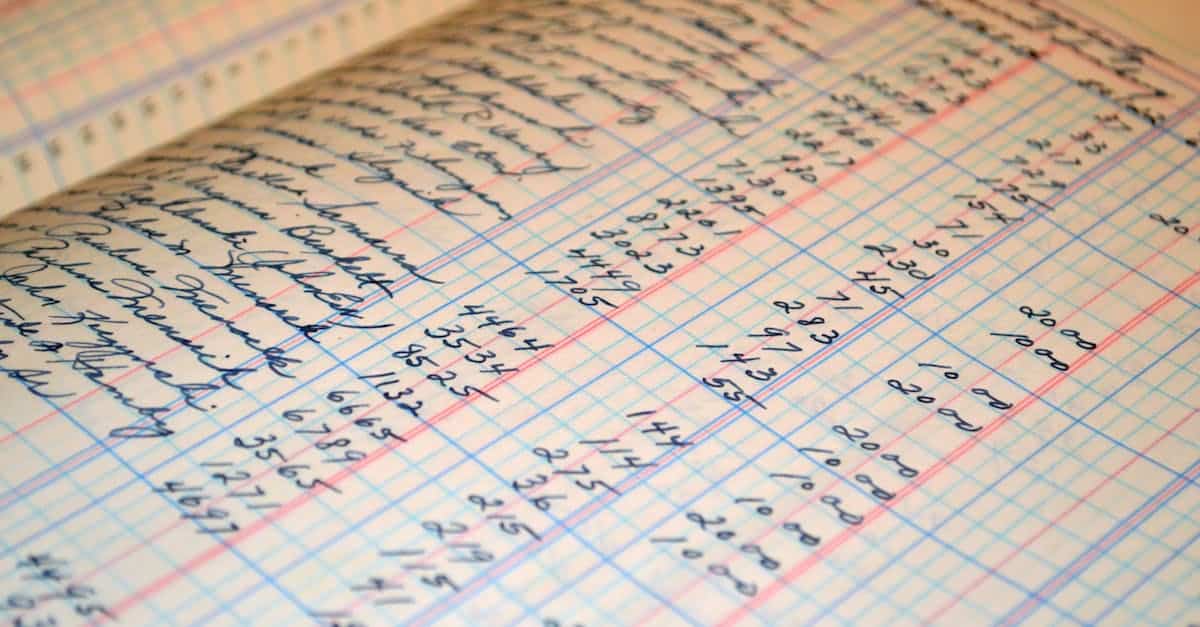

Challenges in Traditional Payment Methods

As technology continues to evolve, traditional payment methods face a number of challenges in meeting the demands of cross-border transactions in 2024. Here are some of the key obstacles that businesses and individuals encounter with traditional payment methods:

- Slow processing times: Traditional payment methods, such as wire transfers or checks, often result in slow processing times. This can lead to delays in cross-border transactions, causing inconvenience and potential lost opportunities.

- High transaction fees: Traditional payment methods typically involve intermediaries, such as banks, which charge fees for their services. These fees can be high, especially for cross-border transactions, eating into profits and increasing costs for businesses.

- Currency exchange complexities: When dealing with international transactions, currency exchange plays a crucial role. Traditional payment methods often involve multiple conversions, which can be complex and costly, adding an extra layer of complexity to the process.

- Lack of transparency: Traditional payment methods lack transparency, making it difficult for businesses and individuals to track the status of their transactions. This lack of visibility can result in uncertainty and hinder effective financial management.

- Increased risk of fraud: Despite efforts to enhance security, traditional payment methods still face the risk of fraud. The reliance on paper-based processes and manual verification increases the vulnerability of transactions, posing a significant threat to businesses and individuals.

To overcome these challenges, businesses and individuals are turning towards innovative payment solutions that offer enhanced efficiency and security. In the next section, we will explore some of these emerging technologies and their potential impact on cross-border payments in 2024.

The Rise of Digital Payment Solutions

In the ever-evolving landscape of cross-border payments, traditional methods are facing significant challenges. Slow processing times, high transaction fees, currency exchange complexities, lack of transparency, and increased risk of fraud have propelled businesses and individuals to seek out alternative solutions. This is where digital payment solutions come into play.

Why are digital payment solutions gaining popularity?

Efficiency: Digital payment solutions offer rapid processing times, significantly reducing the waiting period for cross-border transactions. With just a few clicks, you can send or receive money across borders in a matter of minutes, compared to the days it would take with traditional methods.

Cost-effectiveness: One of the most appealing aspects of digital payment solutions is their affordability. Unlike traditional methods that often involve high transaction fees and hidden charges, digital payments offer competitive rates, saving you money in the long run.

Simplicity: Digital payment platforms have user-friendly interfaces, making it easy for individuals and businesses to navigate and conduct transactions. With just a few simple steps, you can initiate and complete cross-border payments, eliminating the need for complex paperwork and tedious processes.

Transparency: Digital payment solutions enhance transparency by providing real-time transaction updates. You can track your payments from start to finish, ensuring that your money reaches its destination securely and without any hiccups.

Security: With increased cybersecurity measures and advanced encryption technologies, digital payment solutions strive to provide a secure environment for cross-border transactions. Protecting your financial information and safeguarding your money from potential threats is a top priority for these platforms.

The future of cross-border payments is digital

As the demand for seamless and efficient cross-border transactions continues to grow, the popularity of digital payment solutions is expected to skyrocket in the coming years. The rise of technologies such as blockchain, artificial intelligence, and mobile banking will further revolutionize the cross-border payment landscape, offering even greater speed, transparency, and security.

By adopting these innovative payment solutions, businesses can benefit from streamlined operations, reduced costs, and improved customer experiences. Individuals can enjoy hassle-free international money transfers, empowering them to embrace a global lifestyle without the limitations of traditional payment methods.

The rise of digital payment solutions is reshaping the way we conduct cross-border transactions. With their efficiency, affordability, simplicity, transparency, and security, these solutions offer a promising future for faster and more secure international payments.

Blockchain Technology in Cross-Border Payments

Blockchain technology has emerged as a game-changer in the realm of cross-border payments. Its decentralized nature, enhanced security, and transparent transactional records make it an attractive solution for businesses and individuals alike. Harnessing the power of blockchain can revolutionize the way we conduct international transactions in 2024 and beyond.

One of the key advantages of blockchain technology in cross-border payments is its ability to streamline the process. Traditional payment methods often involve multiple intermediaries and complicated settlement procedures, leading to delays and increased costs. With blockchain, transactions can be executed directly between parties, eliminating the need for intermediaries and reducing processing times. Consequently, cross-border payments can be completed faster and more efficiently.

Additionally, blockchain technology ensures improved security and trust in cross-border transactions. Its decentralized structure and cryptographic algorithms make it highly resistant to fraud and tampering. By recording transactions on an immutable ledger, blockchain provides a transparent and auditable record of every payment, reducing the risk of fraudulent activities and enhancing trust between parties.

Furthermore, blockchain technology allows for near-instantaneous currency conversions, eliminating the complexities and costs associated with traditional currency exchange. This feature is particularly beneficial for cross-border payments, as it enables seamless transactions in different currencies without the need for separate conversions or intermediaries. As a result, businesses and individuals can save money on exchange fees and enjoy greater convenience when conducting international transactions.

The integration of blockchain technology in cross-border payments holds tremendous potential for revolutionizing the current payment landscape. Its ability to streamline transactions, provide enhanced security, and simplify currency exchange processes makes it a compelling solution for businesses and individuals seeking efficient and cost-effective international payment options. By leveraging the advantages of blockchain, businesses can unlock new opportunities, improve operational efficiency, and enhance customer experiences in the realm of cross-border transactions.

Advancements in Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are poised to play a significant role in the future of cross-border payments. These technologies have the potential to streamline processes, enhance security, and improve the overall efficiency of international transactions.

One area where AI and ML can bring about significant advancements is in fraud detection and prevention. By analyzing large volumes of data in real-time, AI algorithms can identify patterns and anomalies that may indicate fraudulent activity. This allows financial institutions to identify and address potential risks before they result in financial loss. With the increasing sophistication of fraud schemes, AI and ML can provide an extra layer of protection against fraudulent transactions.

AI and ML can also contribute to the automation and optimization of payment processes. With the ability to process vast amounts of data quickly and accurately, these technologies can help streamline payment reconciliation, improve transaction speed, and reduce manual errors. By automating routine tasks, financial institutions can free up resources and focus on more value-added activities.

Furthermore, AI and ML algorithms can assist in risk assessment and credit scoring for cross-border transactions. These technologies can analyze various factors such as transaction history, creditworthiness, and market trends to provide a more accurate assessment of the risk associated with a particular transaction. This information can then be used to determine appropriate transaction fees, credit limits, and other relevant parameters.

In addition, AI-powered chatbots and virtual assistants can enhance customer support in cross-border payments. These intelligent systems can provide real-time assistance, answer queries, and guide customers through the payment process. This helps improve customer experience and reduces the need for manual intervention.

The future of cross-border payments will undoubtedly be shaped by advancements in AI and ML. These technologies have the potential to revolutionize the payment landscape, offering enhanced efficiency, security, and customer experience. As financial institutions continue to explore and adopt these technologies, we can expect to see even more innovative solutions in the years to come.

A Look into the Future of Cross-Border Payments

As we move towards the year 2024, the landscape of cross-border payments is set to undergo significant changes. The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies will play a pivotal role in shaping the future of international transactions. Let’s take a closer look at what we can expect:

Enhanced Efficiency and Speed

In the coming years, AI and ML will continue to streamline cross-border payments, making them faster and more efficient. These technologies have the potential to automate and optimize various payment processes, reducing the need for manual intervention. With AI-powered algorithms, transaction data can be analyzed in real-time, identifying patterns and making predictions to improve processing times.

Advanced Fraud Detection and Prevention

One of the key concerns in cross-border payments is the risk of fraud. AI and ML offer sophisticated tools to enhance security and address this issue. Machine learning algorithms can learn from vast amounts of data to detect fraudulent activities and flag suspicious transactions. By continuously analyzing transaction patterns and user behavior, AI can provide real-time fraud alerts, minimizing financial losses for both individuals and businesses.

Personalized Customer Experience

In the future, cross-border payment providers will leverage AI and ML technologies to deliver personalized customer experiences. Machine learning algorithms can analyze customers’ transaction history, preferences, and behavior to provide tailored recommendations and offers. This level of personalization will not only enhance customer satisfaction but also foster loyalty.

Improved Risk Assessment and Credit Scoring

AI and ML can revolutionize how risk assessment and credit scoring are conducted in cross-border payments. By analyzing a vast amount of data, including credit history, transaction patterns, and market trends, AI algorithms can provide more accurate risk assessments. This, in turn, enables financial institutions to make informed decisions regarding credit limits and interest rates, ensuring better risk management.

Enhanced Support through Chatbots

Chatbots powered by AI will become increasingly prevalent in customer support for cross-border payments. These virtual assistants are available 24/7, providing instant responses to customer inquiries, thereby improving overall customer satisfaction. By leveraging natural language processing and machine learning, chatbots can understand and resolve complex issues, effectively reducing the need for human intervention.

Conclusion

The potential impact of Artificial Intelligence (AI) and Machine Learning (ML) on cross-border payments is immense. These technologies have the ability to revolutionize the landscape of international transactions, bringing enhanced efficiency, security, and personalized customer experiences.

By integrating AI and ML into cross-border payments, processes can be streamlined, leading to faster and more efficient transactions. Advanced fraud detection and prevention measures can be implemented, ensuring the security of international transactions. Additionally, personalized customer experiences can be created, tailoring services to individual needs and preferences.

Furthermore, the use of AI and ML can improve risk assessment and credit scoring, allowing for more accurate evaluation of creditworthiness. Chatbots can provide enhanced support, addressing customer queries and concerns promptly and effectively.

As we move towards 2024, the integration of AI and ML in cross-border payments will continue to shape the future of international transactions, bringing about increased efficiency, security, and customer satisfaction. Stay tuned for the exciting developments that lie ahead in the world of cross-border payments.

Frequently Asked Questions

Q: What is the potential impact of Artificial Intelligence and Machine Learning on cross-border payments?

A: AI and ML have the potential to streamline cross-border payments, enhance security, and improve efficiency in international transactions. They can bring enhanced efficiency and speed, advanced fraud detection, personalized customer experiences, improved risk assessment and credit scoring, and enhanced support through chatbots.

Q: How will the integration of AI and ML affect cross-border payments in the future?

A: The integration of AI and ML in the future is expected to revolutionize cross-border payments. It will bring enhanced efficiency and speed, advanced fraud detection, personalized customer experiences, improved risk assessment and credit scoring, and enhanced support through chatbots. This integration will shape the future of international transactions.

Q: What are the benefits of AI and ML in cross-border payments?

A: AI and ML in cross-border payments offer several benefits. They streamline processes, enhance security, improve efficiency, bring advanced fraud detection and prevention, provide personalized customer experiences, improve risk assessment and credit scoring, and enhance support through chatbots. These technologies have the potential to revolutionize the landscape of cross-border payments.

Q: How will AI and ML improve security in cross-border payments?

A: AI and ML can improve security in cross-border payments by detecting and preventing fraud more effectively. These technologies can analyze vast amounts of data, identify suspicious activities, and take proactive measures to prevent fraudulent transactions. This enhanced security helps protect the integrity of cross-border payments and safeguard customers’ financial information.

Q: Will AI and ML improve customer experiences in cross-border payments?

A: Yes, AI and ML have the potential to provide personalized customer experiences in cross-border payments. With the help of these technologies, businesses can analyze customer data, understand their preferences, and offer tailored services. Chatbots powered by AI can also provide quick and efficient support to customers, resolving their queries and concerns in real-time.

Q: How will AI and ML impact risk assessment and credit scoring in cross-border payments?

A: AI and ML can significantly improve risk assessment and credit scoring in cross-border payments. These technologies can analyze extensive customer data, assess creditworthiness accurately, and provide more precise risk assessments. This enables financial institutions to make informed decisions and minimize the risk associated with cross-border transactions.

Q: Are chatbots powered by AI beneficial in cross-border payments?

A: Yes, chatbots powered by AI are beneficial in cross-border payments. They provide enhanced customer support, answering queries, resolving concerns, and providing assistance in real-time. Chatbots can also help streamline processes, improve efficiency, and reduce the need for human intervention in customer interactions. They offer convenience and accessibility, enhancing the overall customer experience in cross-border payments.